每日评论0831 降低利率勢在必行

降低利率勢在必行

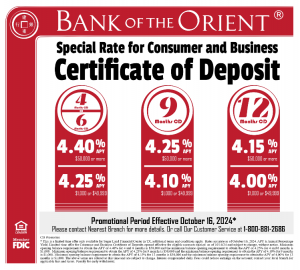

聯邦儲備銀行主席鮑爾近期再度提出可能在九月份開始降息,以面對日愈勞工市埸之減弱,經濟專家們表示,只有大幅降息才會避免經濟衰退。

鮑爾表示,這是我們調整方向之时候了,至於降息之幅度有賴於九月份之統計數字。 一般預料在年底內中央銀行至少會降息一个百分點來緩和經濟上之壓力。

過去三年來,由於國內通貨膨脹之極大壓力,中央銀行一直加息企圖降低通貨膨脹,但是直接影響到各行業尤其是房地產業之發展,近年來房產交易銳減,商業地產開發也受重大影響,高達百分之九之銀行利率是重要之原因。

我們期盼中央銀行未來之降息可以避免經濟之衰退,希望各行各業在較低率貸款之下更活絡起來。

It Is Imperative To Cut Interest Rates

Federal Reserve Bank Chairman Powell recently reiterated that the interest rate may begin to be cut in September to face the weakening labor market. Economic experts believe that only a sharp cut in the interest rate can avoid an economic recession.

As for the magnitude of the interest rate cut, this still depends on new statistics. It is generally expected that the Federal Reserve will cut the rate by at least one percentage point at the end of this year to ease pressure on the economy.

As for the magnitude of the interest rate cut, this still depends on new statistics. It is generally expected that the Federal Reserve will cut the rate by at least one percentage point at the end of this year to ease pressure on the economy.

Over the past several years, due to the great pressure of inflation, the Fed has been raising interest rates in an attempt to reduce inflation, but it has directly affected the development of various industries, especially in the real estate business. With the bank interest rate now up to 9%, it is an important reason for a correction.

We hope that a future Federal Reserve interest rate cut can avoid a recession, and also hope that all levels of business will be more active under the lower rate.